The Tax Exempt Plugin for WooCommerce allows you to offer tax exemption options to selected customers and user roles.

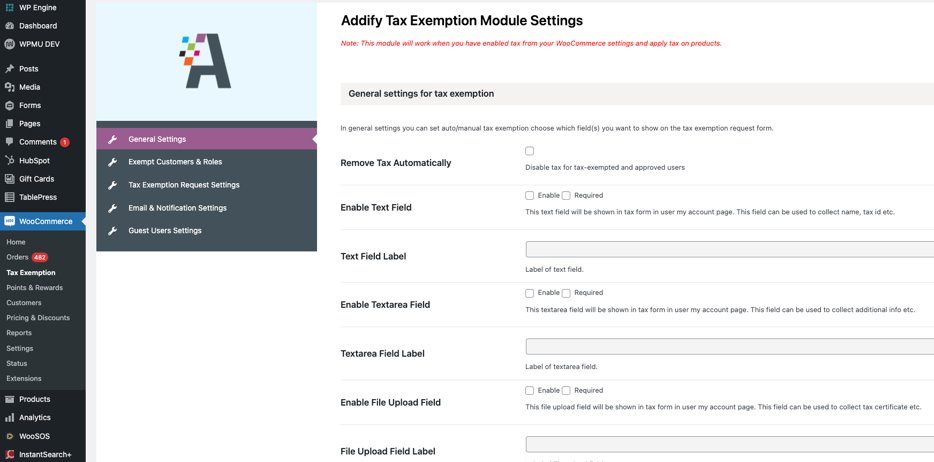

1. Tax Exemption Settings

When the plugin is installed, all settings can be found at WooCommerce>Tax Exemption. There, you can edit the following:- General settings allow you to set which fields you want to show on the tax exemption form

- Exempt Customers & Roles allows you to specify customers or users labeled with a specific role to be exempt.

- Auto Approve or send tax exemption messages to customers or specific users.

- Admin Email & Notification settings.

- Allow guest users to be tax-exempt.

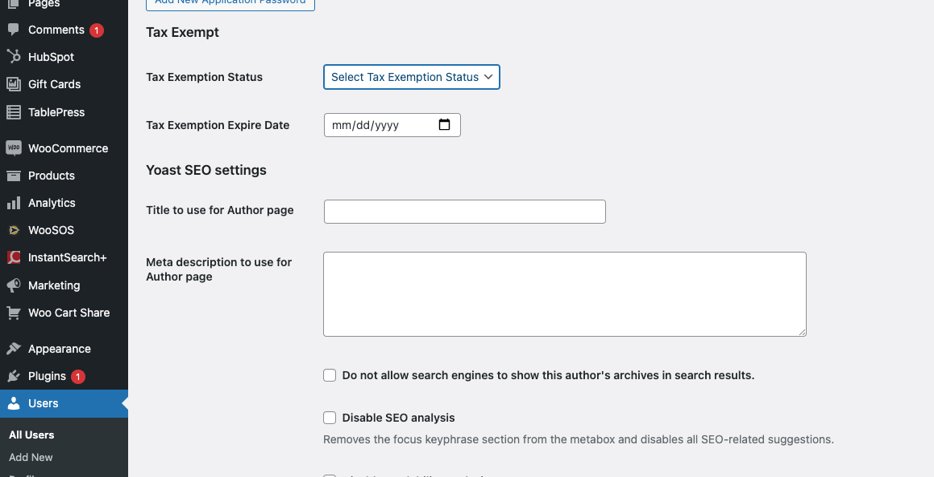

2. Edit Specific Users

- Under "Users," you can edit a specific customer's tax-exempt status.

- Select "Edit," then you can see tax-exempt options, including their status and the date they were tax-exempt.

- You can select "approved," "disapproved," or "expired," and this will update the user without them having to fill anything out.

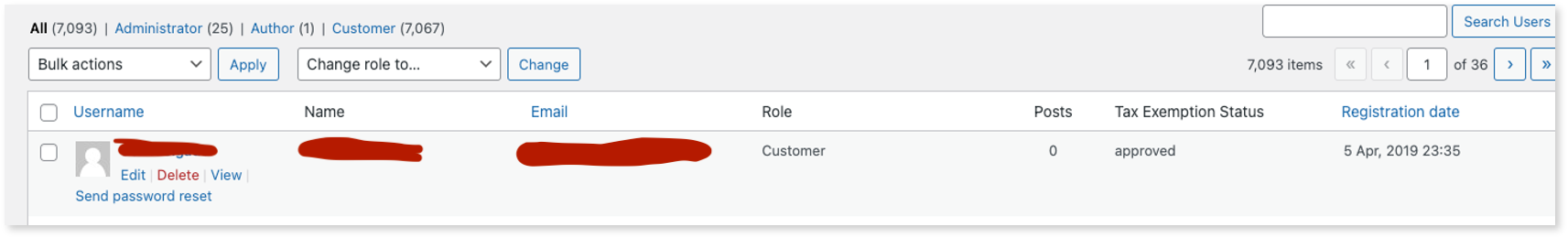

- You can see now in the user page under "Tax Exempt Status" this now says "approved."

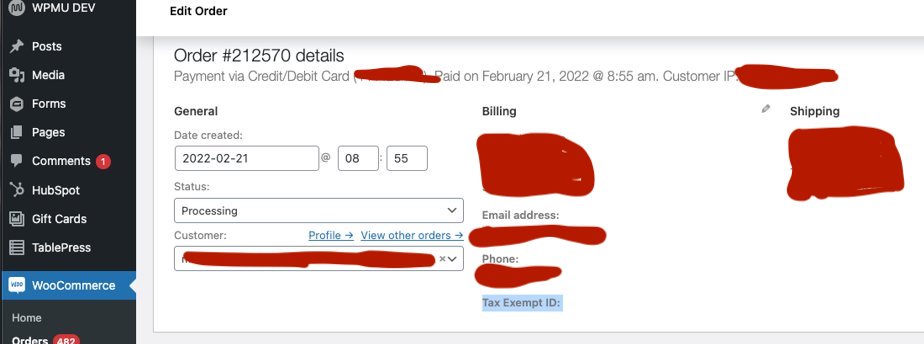

3. Reviewing Orders

- By going to WooCommerce> Orders, you can view the tax-exempt status of previously made orders.

- If a user is tax-exempt, their tax-exempt ID will show up at the bottom of the order page. If it is not showing, then this order did not use Tax Exempt.